30+ Online capital gain calculator

Capital gains tax CGT breakdown. There are some asset classes where you have the choice of using Indexation or not.

How To Invest Money 13 Proven Investment Tips You Must Know Investment Tips Investing Investing Money

In the 2022 budget announcement the federal.

. You can get calculate Gross Long Term Capital Gain by subtracting index cost of purchase expense on transfersell and index cost of. 5 You May save capital gain Rs 1506392- by Investing capital gain amount Rs1506392-maximum 50lakh in Financial year in capital gain bonds of REC NHAI with in Six. Capital Gain Tax with and without Indexation.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. The capital gain tax formula provided is to help you determine an approximate gain and amounts that may be deferred under Internal Revenue Code 1031. You pay no CGT on the first 12300 that you.

Sale of Virtual Digital Asset VDA including Cryptocurrency should not be considered as a capital gain starting from FY 2022-23 AY 2023-24 but should be treated as. Note - Total profit is more than Tax Allowance 1230000 therefore Capital Gains Tax is payable. So the current rate is.

The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. For Capital Gains made during the 20102011 Tax Year the calculation is quite complicated as the Government changed the tax scheme from 23rd June 2010. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property.

Read on to find out how. MC30 is a curated basket of 30 investment-worthy mutual Fund MF. For this tool to work you first need to state.

Calculate the Capital Gains Tax due on the sale of your asset. Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. Long Term Capital Gain Tax rate is 20.

Email Me The Results. It calculates both Long Term and. This is true for debt funds and FMPs.

Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. Use this tool to calculate how much capital gain tax you will need to pay on gains from your asset sell. Invest In MC 30.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. However with the availability of Fisdoms online capital gains calculator investors can easily calculate this tax liability within a matter of a few seconds. FAQ Blog Calculators Students Logbook Contact LOGIN.

Calculate the Capital Gains Tax due on the sale of your asset. From this date Capital Gains. September 1 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index.

Iabvwdtjufzqum

Ex99 2 047 Jpg

Same Chart Different Traders Video Trading Charts Forex Trading Quotes Stock Trading

Want To Get Into The Best Trades Possible Don T Forget To Save In 2021 Stock Trading Learning Trading Quotes Forex Trading Quotes

Cmbs Disputes On The Horizon April 2021 Quinn Emanuel Urquhart Sullivan Llp Jdsupra

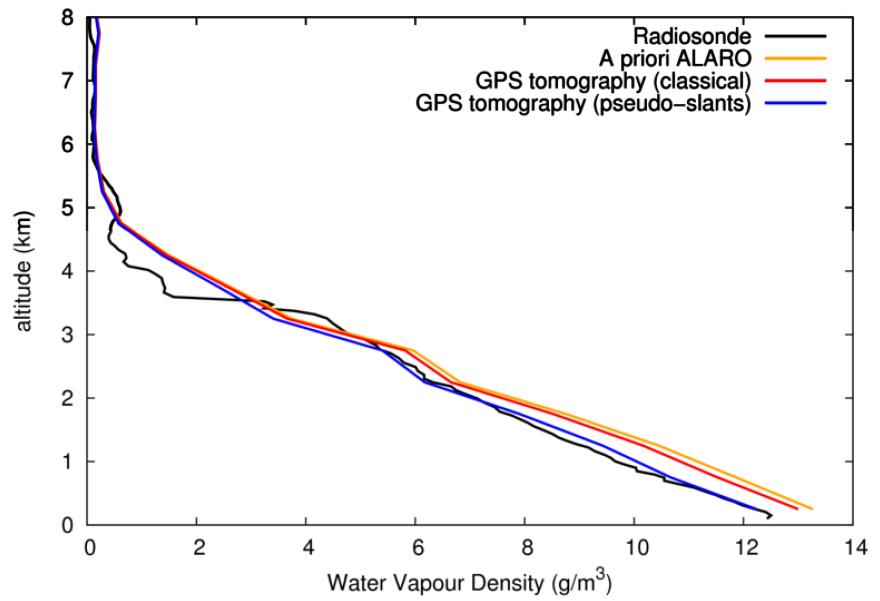

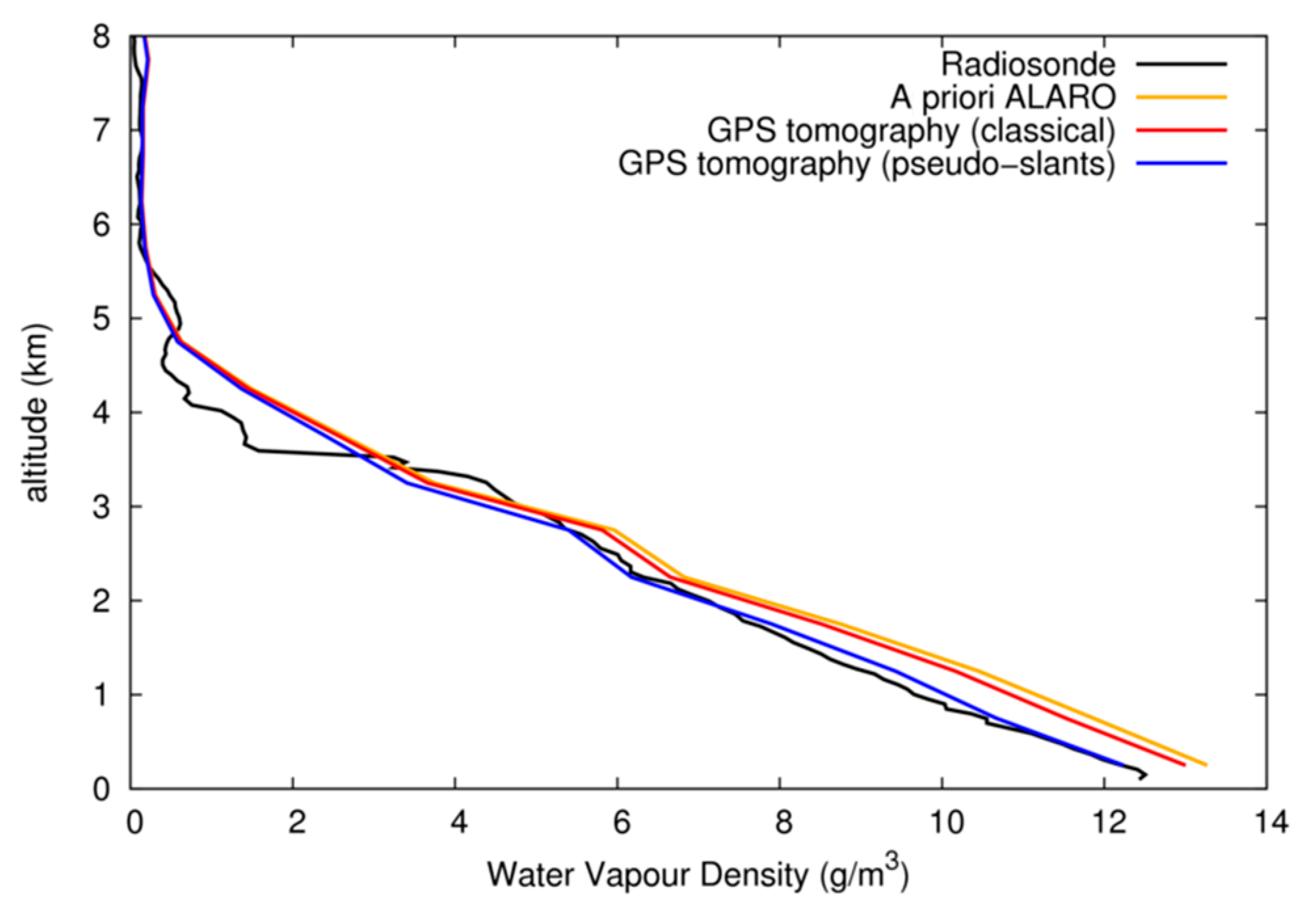

Remote Sensing Free Full Text Cross Comparison And Methodological Improvement In Gps Tomography Html

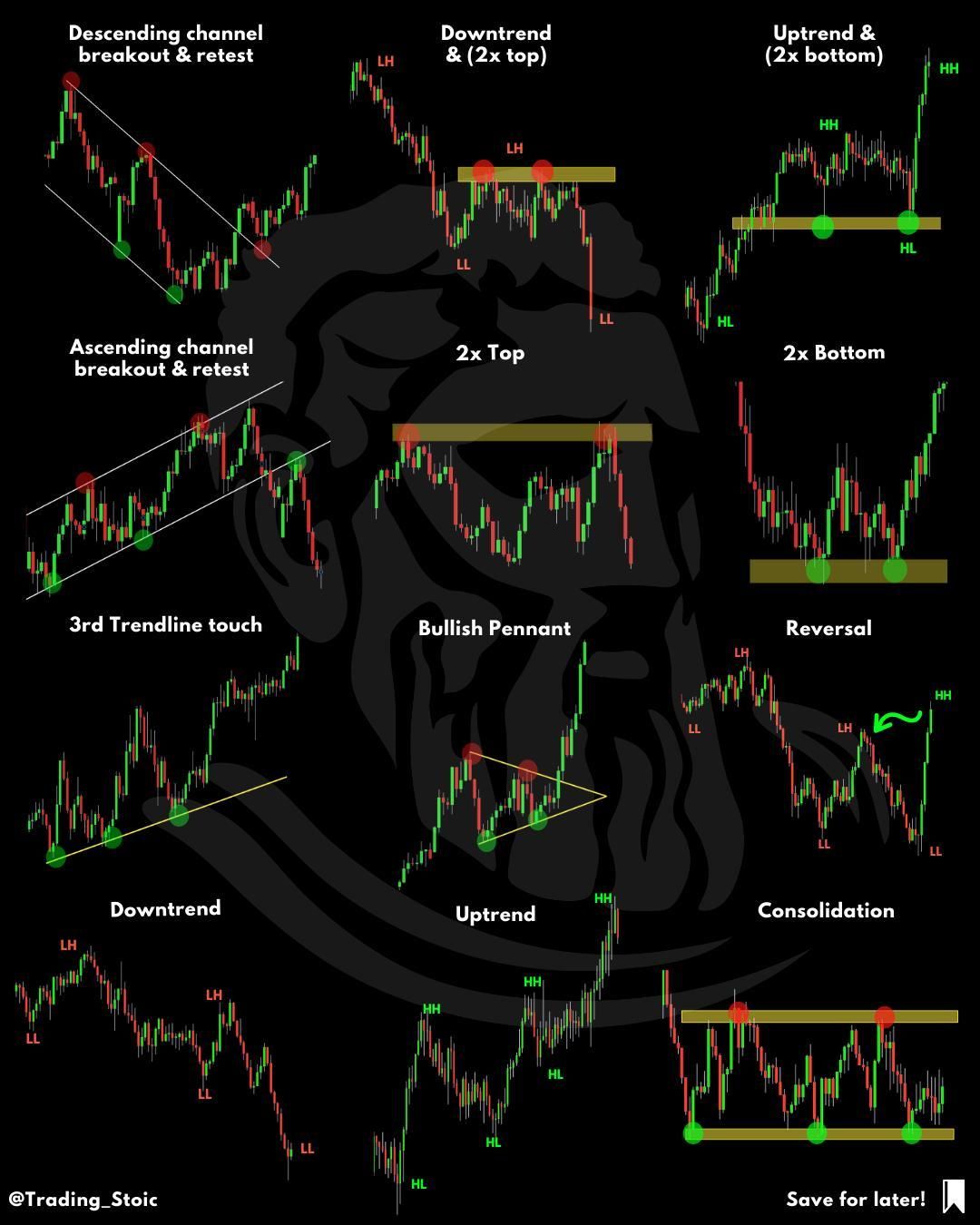

Different Price Action Patterns Which One Is Your Favourite Don T Forget To Sav Online Stock Trading Forex Trading Strategies Videos Stock Trading Strategies

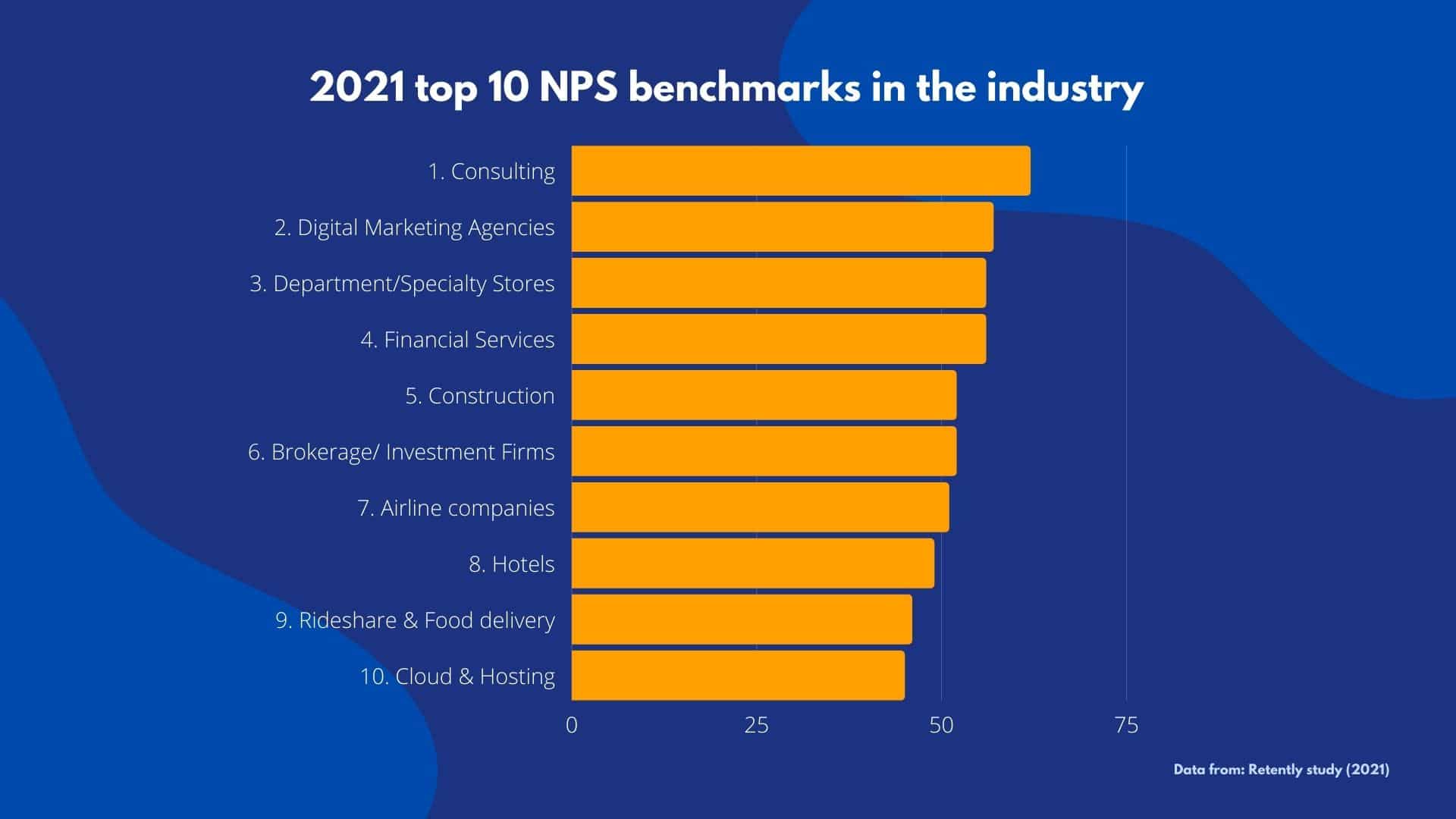

31 Nps Benchmarks For Leading Industries In 2021 Questionpro

30 Best Pitch Deck Examples Templates From Famous Startups

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Pin On Cdo Chief Digital Officer Agile Fuhrung Digitale Transformation

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

Income Statement Example Template Format Income Statement Statement Template Business Template

Candlestick Patterns And What They Mean Trading Charts Candlestick Patterns Forex Trading Quotes

Dean Lebaron S Treasury Of Investment Wisdom Thirty Great Investing Minds Lebaron Dean 9780471152941 Amazon Com Books

Defi Crypto Tax Guide Yield Farming Lending Liquidity Pools

Remote Sensing Free Full Text Cross Comparison And Methodological Improvement In Gps Tomography Html